Here it is: the data-informed equation for how much money organizations should be spending in order to maximize opportunities for financial success.

Data suggest that approximately 70% of visitor-serving organizations are not investing optimal funding in acquiring audiences.

Marketing budgets seem to be an unnecessarily emotional topic for many nonprofit organizations. Optimizing marketing investments – like admission prices – are increasingly a product of math and science (read: decidedly not “intuition” or “trial and error”). They need not be based on fuzzy-feelings and inappropriate loyalties to failing business models that ignore the realities of the outside world.

We live in a pay-to-play world where organizations have to spend money to make money. When it comes to budgeting for audience acquisition costs, many organizations seem to have fallen into that familiar trap of “last year plus 5%” that lazily assumes the continued efficacy of the same old platforms and strategies. Of course, such a strategy completely ignores shifting advertising cost factors, evolving platforms and channels, and technological innovation. Say it aloud: Nonprofits do not operate in a vacuum and cannot afford to ignore the changed economies and technologies of the world around them.

Several organizations that have made this realization have asked IMPACTS if there is an equation to inform their audience acquisition costs so as to maximize their opportunities for financial success. And, the findings of a three-year study suggest: Yes, there most certainly is!

The key equation for acquisition costs

Let’s first establish a few definitions and “same page” this conversation:

Audience acquisition costs are the investments that an organization makes in advertising, public relations, social media, community relations…basically, anything and everything intended to engage your audiences.

Market potential is a data-based, modeled outcome that indicates an organization’s potential engagement with its audiences. For most organizations, “market potential” primarily concerns onsite visitation. In other words, it answers the question, “If everything goes well, how many people can we reasonably expect to visit us this year? (NOTE: Market potential may not match an organization’s historic attendance – organizations “underperform” their market potential all the time…for reasons that we’ll soon explore.)

Earned revenues are the product of admissions, memberships, merchandising, food and beverage, facility rentals…basically, all revenues attendant to the onsite experience that are supported by audience acquisition investments. These revenues exclude annual fund, grants, endowment distributions and other sorts of philanthropy.

Here’s the equation to maximize your market potential (as suggested by the recently completed three-year study):

Expressed another way: Optimal Audience Acquisition Costs = 12.5% of Earned Revenues. For example, if your organization generates annual earned revenues of $20 million, then this would suggest an annual audience acquisition investment of $2.5 million.

Further, additional analysis would suggest that 75% of the audience acquisition costs should be earmarked to support paid media (i.e. advertising). So, of the $2.5 million suggested above for audience acquisition, nearly $1.9 million should support paid media. The remaining 25% (or, in this example, approximately $600,000) would support agency fees, public relations expenses, social media, community engagement – all of the programs and initiatives that round out an integrated marketing strategy. Forget to invest that 25% at your own peril. Earned media is critical for success and many social media channels are also becoming pay-to-play.

And now the other side: Why such a large percentage allocated to paid media? Again, ours is an increasingly pay-to-play world. Rising above the noise to engage our audiences frequently means investing to identify and target audience members with the propensity to act in our interest (e.g. visit our organizations, become members, etc.). There is tremendous competition for these same audience members – from the nonprofit and for-profit communities alike. Think of the most admired and successful campaigns in the world – do Nike and Apple rely on 3am cable TV “bonus” spots that they get for a reduced rate and that don’t hit target audiences? Nope. While earned media plays a major role in driving reputation, paid media plays an important role in a cohesive strategy – and doing it right costs money.

The equation in action

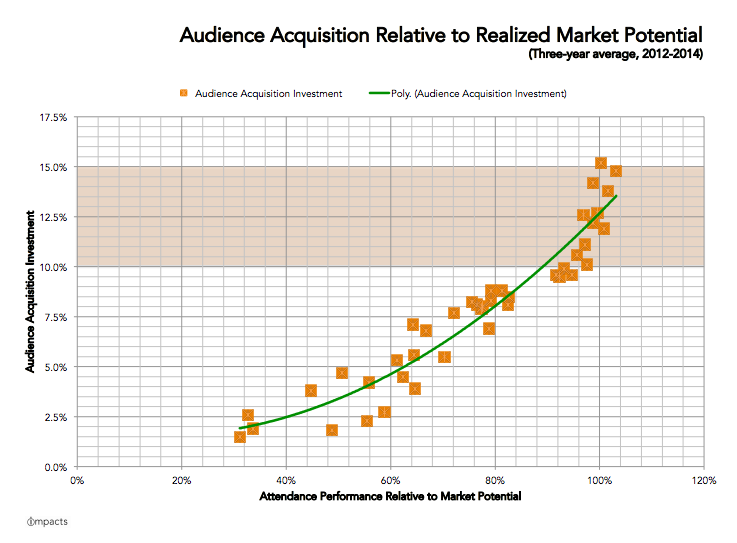

How does the study suggest this equation? Check out the chart below. It indicates the relationship between performance relative to market potential (i.e. how well the organization actually performed when compared to its market potential) and the audience acquisition investments made by 42 visitor-serving organizations (including aquariums, museums, performing arts organizations, and zoos) over a three-year period:

The data strongly suggests that there is a correlation between an optimized audience acquisition investment and achieving market potential. It also indicates the perils of “underspending the opportunity” – a modest investment intended to achieve cost-savings may forfend exponential revenues. (Though the data never has – and likely never will – support it, many organizations seem to foolishly hold dear to the notion that they might somehow “save their way to prosperity.”)

Additional analysis indicates that the studied organizations invested an average of 7.9% of earned revenues toward audience acquisition…but only achieved 76.0% of their market potential. However, the organizations achieving ≥95.0% of their respective market potentials invested an average of 12.7% of their earned revenues toward audience acquisition.

In no instance did an organization investing less than 5.0% of earned revenues on audience acquisition achieve greater than 60.0% of its market potential.

Overall, the data suggests that the “sweet spot” for audience acquisition investment is in the 10.0-15.0% of earned revenue range. Splitting the difference (and further supported by the findings of organizations achieving ≥95.0% of their market potential in the study) gives us our 12.5%.

NOTE: Before we start parsing the nuances of media planning and creative approaches to advertising, let’s baseline the conversation by acknowledging that each of the studied organizations were led by competent persons operating with the best of intentions. Yes – “great creative” matters – but it doesn’t offset an inadequate marketing investment. Sure, a viral social campaign helps…but it doesn’t negate the importance of other media channels. In other words, there aren’t exemptions from the need to invest in audience acquisition for visitor-serving organizations that rely on earned revenues.

If your organization is struggling to meet its market potential, it may have less to do with all of the usual suspects such as parking, staff courtesy, special exhibits, pricing, etc. and more to do with an antiquated view of the necessity of meaningful marketing investments. Can your organization overspend? You bet. However, that doesn’t seem to be the problem confronting most visitor-serving nonprofit organizations. If your organization is struggling to meet its market potential, then it may be that in today’s pay-to-play world, you simply aren’t paying enough to play in the first place.