Organizations don’t have to guess when it comes to determining an optimal admission price.

Let’s try something new – starting today. I’d like to introduce you to a new project: Know Your Own Bone: Fast Facts for Cultural Executives. Traditional Know Your Own Bone posts will continue to be posted every other Wednesday. In the weeks between, I will be posting short (around three minutes or less), Fast Facts videos featuring a key takeaway for cultural executives and staff members alike. I hope that you will provide me with feedback, and I am eager to know what you all think! Let’s start here:

Admission pricing is a science. Check out the video to learn why.

A deeper dive into data:

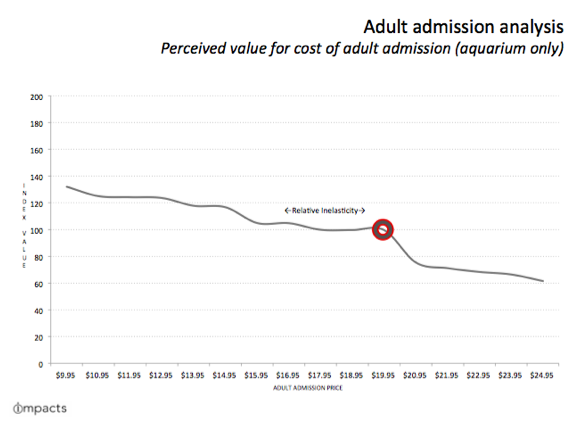

Unintentional collusion drives many an organization’s pricing strategy, but it’s a bad practice (or, at least a silly one). Today, your organization should be looking at data to inform its optimal price point for admission. Here’s an example of an organization’s data-informed pricing “sweet spot” that data suggest is neither leaving money on the table nor jeopardizing attendance. Every organization has this kind of optimal price point:

Your pricing should be contemplative of the attributes of your organization’s high-propensity visitors (jargon translated: it should consider the people who profile as being actually interested in attending your organization). The above example indicates relative price inelasticity between $15.95 and $19.95 – suggesting that as many folks would visit the organization at a $19.95 as they would if the price were $15.95. If this is your organization and you are charging $15.95, you’re not losing visitors – you’re losing revenue that can help keep your doors open and your mission alive.

Different markets, different audiences, and different experiences demand different price points, so I want to emphasize that while this graph is a real example, it’s not necessarily a replicable model for your organization. (Read: I’m not encouraging everyone out there to charge $19.95. I would encourage THIS organization to change $19.95.)

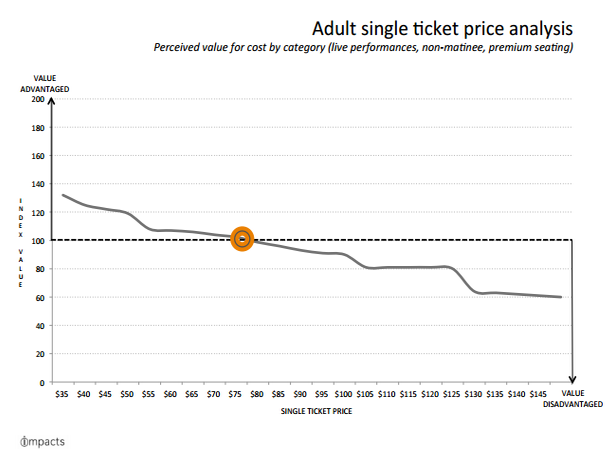

To illustrate, here’s another example of a pricing analysis for a different organization and experience:

Finding an organization’s optimal price point has two, basic steps: Collecting data and modeling the data. Optimal pricing is informed by the type of data typically acquired via the conduct of an awareness, attitudes, and usage study that includes price-related metrics and perceptions from visitors and non-visitors alike. From there, price elasticity of demand models aid organizations in quantifying the demand for your experience. If you don’t have the know-how the collect this data on your own or you need help with the models, universities make excellent partners – as do professionals with experience working in this space! The point is: In today’s world – in which data is increasingly available, and more organizations are collecting it – there’s no excuse for blindly following the “leader” or simply guessing when it comes to your organization’s optimal admission price.

Words to Know to Be In-the-Know:

Unintentional collusion:

Many organizations unknowingly have strategies based upon unintentional collusion. Unintentional collusion is what happens when an organization follows the “leader” thinking the leader knows something that they don’t. Basically, it’s when somebody guesses and other organizations simply copy that guess. When organizations do this, they reaffirm one another’s unscientific strategies.

Value advantaged:

Admission pricing that is set too low and thus “leaves money on the table” for an organization. It is a price point that fails to maximize the data-informed level of revenue that an organization may be able to achieve.

Value disadvantaged:

Admission pricing that is set too high and risks jeopardizing attendance. It is a price point that fails to inspire visitation among those who profile as likely visitors because the high cost to attend poses a barrier to engagement.

Let’s stop guessing when it comes to admission pricing. Today, pricing is not an art. It’s a science.