Data suggest a “new” draw to your organization that is now key to engaging both visitation and donor support. Well, actually, it’s not “new” – it’s the reason why your organization exists: Your mission. How credibly the market perceives your organization in terms of your ability to effectively deliver on your mission has a very strong positive correlation with your organization’s financial performance.

An analysis of the recent financial performance of a large and representative number of visitor-serving organizations coupled with the public perceptions of these same organizations reveals an outcome that may not be surprising for those who keep tabs on consumer behaviors: Organizations perceived as “best-in-class” in terms of mission delivery reliably outperform organizations that rely more on their reputations as “attractions” when it comes to their financial bottom lines. In other words, mission and business are not in conflict – being superlative at your mission is good business!

There are three overall findings relating to the “mission is good business” trend:

1) Organizations perceived as more credible actors in terms of fulfilling their mission financially outperform peer organizations whose reputational equities relate primarily to their roles as attractions

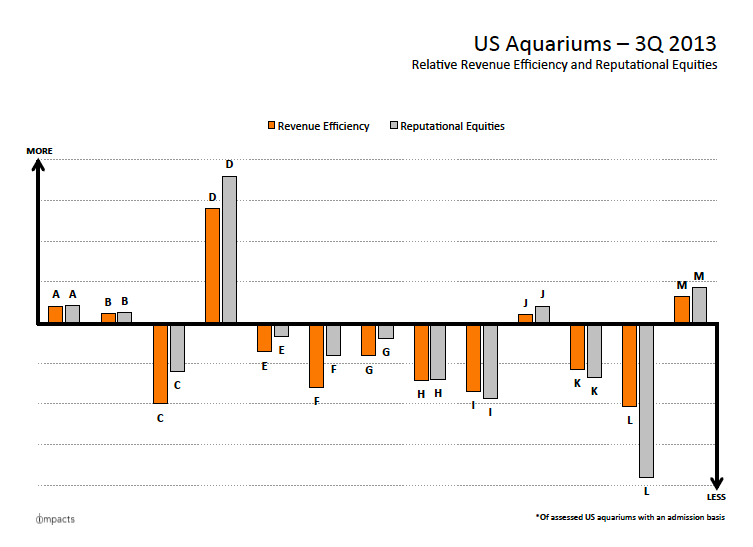

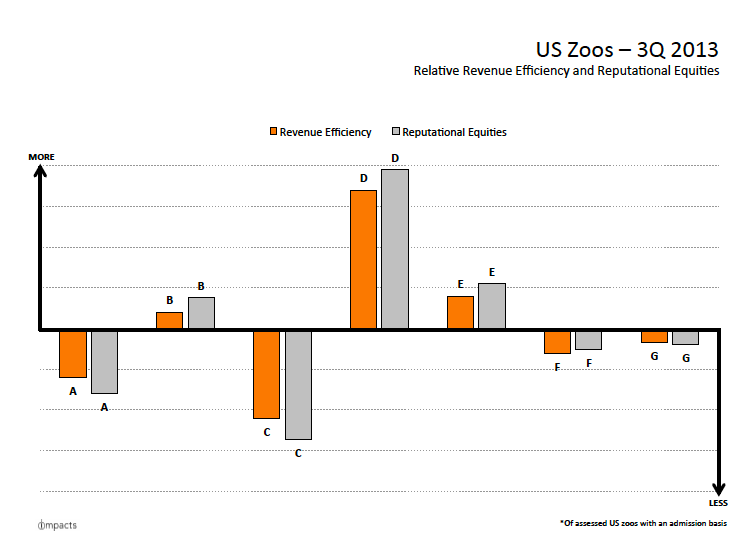

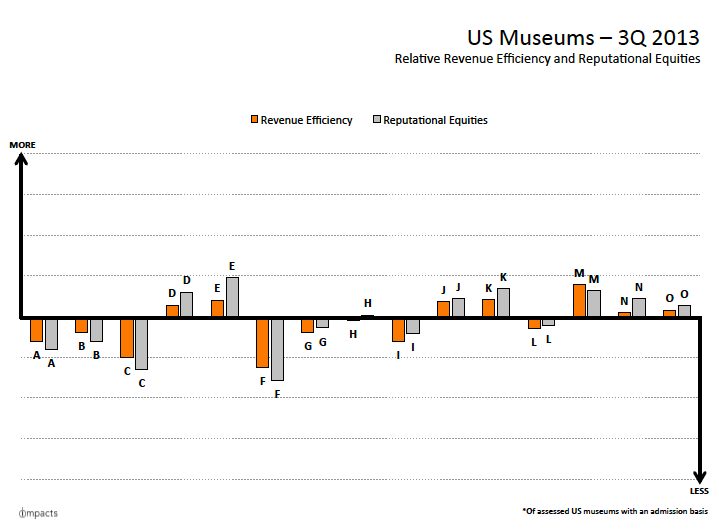

IMPACTS collects and analyzes attitudinal and awareness data for 224 visitor-serving organizations in the US (and that may even include your own). This data and analysis informs the development of key performance indicators that reveal trends and correlations affecting visitor-serving enterprise. The charts below indicate the relationship between 35 visitor-serving organizations’ financial performance in terms of “revenue efficiency” coupled with the market’s perception of these same organizations’ “reputational equities.” (In the interest of maintaining appropriate confidences, I’ve “anonymized” the findings)

First, a few quick definitions (with advance apologies for the analytical jargon):

Revenue Efficiency: A composite metric contemplative of onsite-related earned and contributed revenues (e.g. admission, contributions, grants, membership, programs) contemplated relative to the cost to deliver onsite services (i.e. operating expenses) and the number of persons served onsite. Generally, a more “revenue efficient” organization exhibits more favorable financial key performance indicators (e.g. greater revenues, greater net operating surplus) and reduced financial volatility than does a less revenue efficient organization. Data informing the IMPACTS revenue efficiency calculation are commonly available in an organization’s financial statements, annual reports, and Form 990 filings.

Reputational Equities: A composite metric contemplative of numerous visitor perceptions such as reputation, trust, authority, credibility, and satisfaction that collectively indicate the market’s opinion of an organization’s relative efficacy in delivering its mission. As mentioned previously, IMPACTS collects perceptual data from 224 visitor-serving organizations in the US to inform its reputational equities calculation.

Aquariums are a good place to start because (a) in addition to tackling the mission of inspiring audiences, they are also increasingly engaging audiences on broader conservation issues; and (b) aquariums tend to be more reliant on earned revenues than their museum and zoo brethren who may have greater public funding and/or endowment support. In short, absent the safety net of large endowments and government appropriations, aquariums are among the most market-driven businesses in the nonprofit sector, and translating positive reputational equities has an enormous financial benefit for these organizations (and, in inverse, lessened reputational perceptions bear tremendous risk to an organization’s bottom line).

Generally, revenue efficiency follows reputational equities (so working to increase reputational equities tends to positively affect revenue efficiency). Thus, we can reasonably surmise that year 2014 may bring continued challenges for Aquariums H, I, K and L should they choose not to prioritize remedy for their lacking perceptions as credible actors when it comes to delivering on their missions.

Much like aquariums, the zoos that are perceived as credible actors in regard to their mission achieve the greatest revenue efficiency. Again, in the example indicated by the assessed zoos, the relationship between reputational equities as a predictor of financial success is clear and compelling.

Again, when segmented by museums (in the above example, all of the assessed organizations would be rightfully classified as either “art” or “natural history” museums), the trend holds true: Those museums perceived by the market as the most esteemed in terms of fulfilling the promise of their missions achieve the greatest financial performance.

You’ll notice that out of the 35 organizations represented in this assessment, Museum H is the only organization that does not indicate the relationship between reputational equities and financial performance – and, even in this exception to the trend, the difference is very slight.

2) Your organization must increasingly be MORE THAN an attraction but it still must be an entertaining destination.

The reputational equity metric is contemplative of overall satisfaction and data indicate that providing an entertaining experience is an extremely important component of visitor satisfaction. To be clear: The data do not support abandoning efforts to deliver an entertaining experience in the hopes of enhancing your organization’s reputation as a credible, mission-related authority. Instead, data support efforts to underscore your social mission and demonstrate topic expertise alongside location-based content to help drive visitation and provide insight into the entertaining and inspiring experiences that you provide.

Simply put, people want to visit organizations that are more than just attractions.

3) The importance of underscoring reputational equities is likely to grow as millennials increasingly comprise a greater percentage of museum audiences

The analysis indicating the relationship between favorable reputational equities and financial performance for visitor-serving organizations aligns with multiple findings concerning the influence of social missions (in business-speak, think “corporate social responsibility”) on consumer purchasing behaviors. Namely, people – and especially millennials – are more likely to purchase products that support a mission.

The data has long suggested that millennials are particularly public-service motivated, and as Gen Y has become a more powerful market segment (indeed, millennials are the largest generation in human history), organizations have experienced a “market shift” in support of organizations that support “social good.”

That sounds great for educational, conservation, and cultural organizations such as museums, aquariums, and zoos, right? Well…maybe not…especially because millennials are generally sector agnostic. Millennials tend to support organizations and businesses that appeal to them regardless of whether or not there is 501(c)3 designation involved. (In other words, while the IRS may care about your tax-exempt status, the market increasingly does not!) This means that in terms of securing support, many nonprofits are “competing” directly with for-profits for the market’s time, attention, and resources.

Organizations that have marketed themselves too heavily as attractions without underscoring their mission and social impact have lost a valuable opportunity to differentiate themselves as superlative to a critical demographic. Potentially worse yet, they may have built their reputations based on motivations that millennials don’t care about. Case-in-point: Take a look at what millennials want out of a zoo, aquarium, or museum membership compared to older generations.

Organizations that the market favorably perceives as more than “just an attraction” tend to financially outperform organizations perceived primarily as attractions. Money follows reputational equities. Zoos, aquariums, and museums that have been trying to “sell” the wrong brand attributes may find themselves struggling even more in the future as emerging audiences emphasize mission and social impact as vital attributes of the relationship that they seek with the organizations that they support. Year 2013 was only the tip of the iceberg. Perceptions are changing and the data affirms a strong, encouraging trend:

Finally, it’s cool to be kind. More than that, it’s plain good business.